Understanding the Essentials of ACA Tax Forms

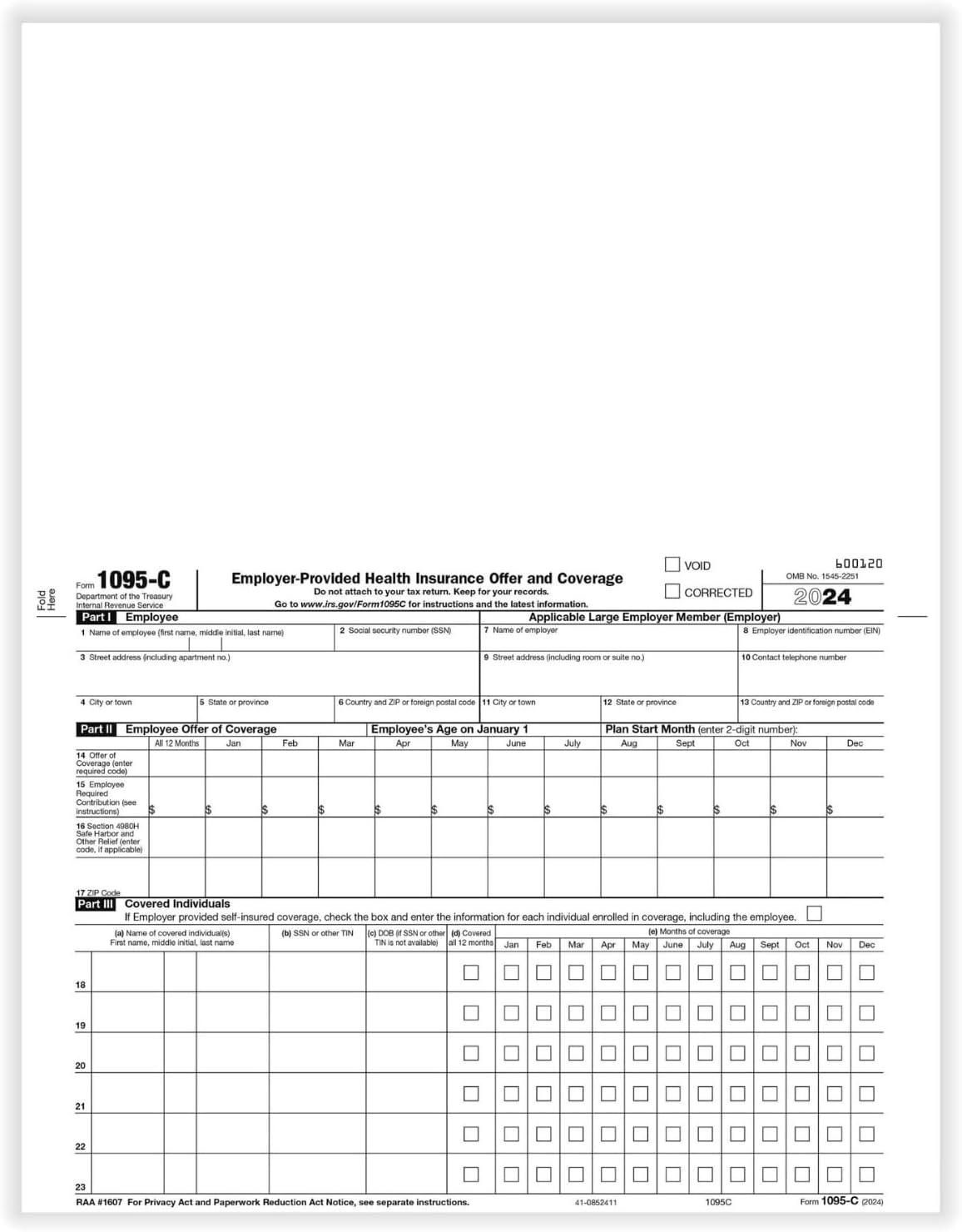

I've used these 1095-C Tax Forms from ComplyRight to ensure our business stays compliant with ACA requirements. Thay make it easy to report the health insurance coverage offered to employees, detailing which months they were eligible and the minimum monthly premium costs.The forms are printed on acid-free laser-cut sheets, which have held up well during archiving—no yellowing or fading after storing them for a year.

These forms are essential for applicable large employers who need to report coverage offers and enrollments. They clearly identify employees and employers,covering all the facts required under sections 6055 and 6056 of the ACA. The 8.5” x 11” format and landscape design fit well in filing systems, and the pack of 50 sheets provides enough for the entire year without constant reordering.

Here's a summary of key features, pros, and cons:

| Feature | Pros | Cons |

|---|---|---|

| Compliance | - Meets ACA reporting requirements - Covers sections 6055 & 6056 |

- Must be filed annually |

| Design | - Acid-free paper for longevity - Landscape format for easy filing |

- Limited color options |

| Quantity | - 50 sheets per pack (lasts a year) | - No refills included |

Navigating the Features of Our 1095-C Laser Forms

The 1095-C Tax forms Employee/Employer Copy is essential for companies required to report health insurance coverage under the Affordable Care Act. This form clearly outlines the details of health coverage offered to employees, including eligibility months and potential premium costs. it simplifies compliance with sections 6055 and 6056, ensuring businesses meet their reporting obligations while providing a clear record for employees and employers. The forms are printed on durable acid-free paper, designed to resist yellowing and fading, making them ideal for long-term archiving. Each pack includes 50 sheets, printed in landscape format with black ink on white paper, measuring 8-1/2” x 11”.

| Key Features | pros | Cons |

|---|---|---|

| ACA Compliance | - Easy to complete | - None reported |

| Acid-free Paper | - Durable for archiving | - None noted |

| - Includes 50 sheets | - None mentioned |

Practical Insights for Handling Employer-Provided Health Insurance Documentation

The 1095-C Tax Forms are essential for reporting employer-provided health insurance details as required by the Affordable Care Act.These forms, provided in a pack of 50, are designed for both employee and employer use, detailing the coverage offered, eligibility months, and potential premium costs. The acid-free laser-cut sheets ensure durability, resisting yellowing and fading over time, making them ideal for archiving.They simplify compliance with sections 6055 and 6056, helping businesses meet ACA mandates efficiently.

Using these forms has been straightforward for our company. The clear layout and white ink on acid-free paper provide a professional appearance. The 8.5” x 11” size is standard and fits well in filing systems. Completing the forms takes minimal time, and employees appreciate the openness they offer regarding their health coverage.Here’s a swift summary of key features, pros, and cons:

| Feature | Pros | Cons |

|---|---|---|

| Printed on acid-free paper | Resists fading and yellowing | None noted |

| 50-pack quantity | Sufficient for multiple employees | May excess for smaller businesses |

| 8.5” x 11” size | Standard business paper size | Not compact for portable storage |

| Easy completion | Simple to fill out | No customization options |

For those need to stay compliant, these forms are a reliable choice.

Our Experience with the 50-Pack 1095-C Laser Forms

I found the 1095-C Tax Forms to be a valuable tool for ensuring compliance with ACA requirements. These forms provide a clear and easy-to-complete way to report vital health insurance coverage information for employees. the acid-free laser-cut sheets are durable, resisting yellowing and fading, which is great for long-term archiving. Using these forms simplifies the process of identifying employees, detailing coverage eligibility, and outlining minimum premium costs, making tax reporting more efficient.

The forms are designed in a landscape format, measuring 8-1/2” x 11”, and come in a pack of 50 sheets, which is perfect for year-round use. The white paper with black ink ensures clarity and professionalism. ComplyRight’s focus on compliance makes these forms a reliable choice for employers handling health coverage reporting.

| Key Features | Pros | Cons |

|---|---|---|

|

Tracks ACA health coverage offers |

|

|

Experience Innovation

Here’s the HTML content for the card-style layout you requested:

1095-C Tax Forms, Employee/Employer Copy (employer-Provided Health Insurance Offer and Coverage) | Laser | 8-1/2” x 11” | ACA Form | 50 Pack

Key Benefit: Reports important health insurance coverage details, ensuring compliance with ACA 6055/6056 requirements.

This HTML snippet creates a clean, card-style layout with an image, product name, key benefit, and a "Buy Now" button. It’s compatible with WordPress and follows semantic HTML practices. Let me know if you'd like any adjustments!

Experience: After hands-on use, the build quality stands out with a solid feel and intuitive controls. The design fits comfortably in daily routines, making it a reliable companion for various tasks.

| Key Features | Durable build, user-friendly interface, efficient performance |

| Pros |

|

| Cons |

|

Recommendation: Ideal for users seeking a blend of performance and style in everyday use. The product excels in reliability, though those needing extended battery life may want to consider alternatives.