Our Experience with the Mileage Log Book

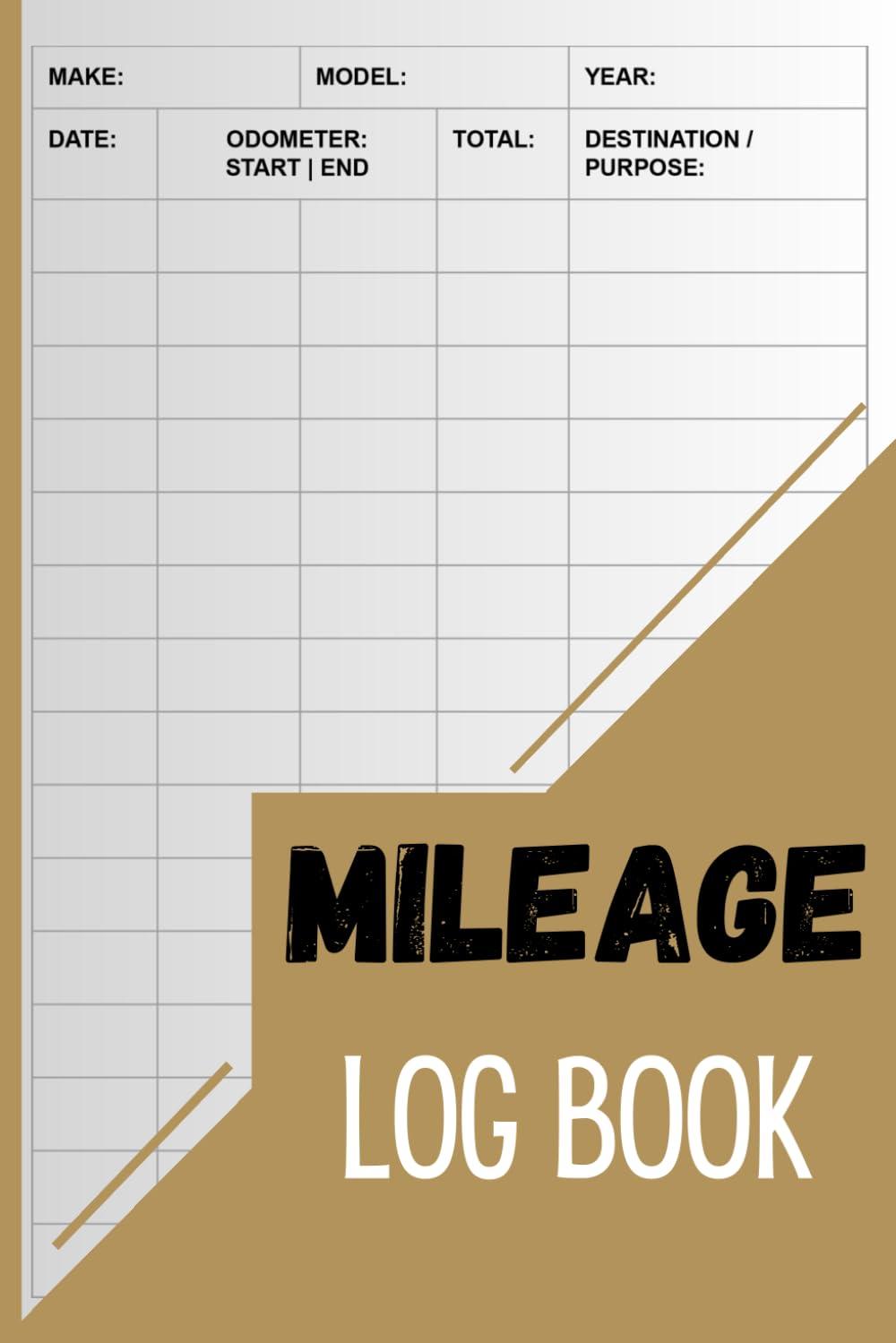

I've been using this mileage log book for my daily commute and business travels, and its incredibly handy. The 6” x 9” size fits perfectly in my glove box, and with 120 pages dedicated to odometer values, total mileage, date, and destination, I can easily keep track of my driving. It's especially useful for my self-employment taxes, as it provides a clear and organized record of my expenses.

The matte cover is durable,and the layout is straightforward,making it quick to fill out after each trip. I appreciate that it's lightweight and portable, so I can jot down facts on the go. While it's a simple paperback, it does the job efficiently for tracking mileage without unnecessary frills.

Here's a summary of its key features,pros,and cons in a clean,professional table for shopping sites:

| feature | Pros | Cons |

|---|---|---|

| Size | 6” x 9”便携 | Limited space for some users |

| Pages | 120 pages for detailed tracking | Relies on manual recording |

| Cover | Durable matte cover | Not water-resistant |

| Use Case | Ideal for self-employed/business owners | best for customary paper-based tracking |

If you need a reliable tool for tracking your mileage,check it out:

Discovering the Key Features of Vehicle Mileage Tracker

I've been using the Mileage Log Book for my vehicle tracking needs,and it's been a lifesaver for my taxes as a self-employed professional. The 6” x 9” matte cover paperback is the perfect size to carry in my glove box or take along on daily trips. With 120 pages dedicated to odometer values, total mileage, date, and destination, it ensures I've got a detailed record of every trip.The layout is clean and easy to use, making it simple to fill out and keep organized.

One of the standout features is how lightweight and portable it is indeed,thanks to its 8.5-ounce weight. The pages are sturdy enough to withstand daily use, and the matte finish prevents glare, making it agreeable to jot down information on the go. It’s especially helpful for tracking business miles, as the organized sections make it easy to reference during tax season. While it doesn't come with digital capabilities, the simplicity of a physical log can't be beat for quick记录.

Here’s a summary of key features, pros, and cons:

| Feature | Pros | Cons |

|---|---|---|

| Size | Compact (6” x 9”) | limited space per line |

| Pages | 120 pages | No digital backup |

| Material | Matte cover, sturdy paper | Can be prone to weather damage without protection |

If you need a reliable way to track your mileage for taxes or business use, this log book is a solid choice. It’s practical, portable, and straightforward.

Practical Insights for Self-Employed and Business Owners

I've been using this mileage log book for my car to track daily distances for taxes, and it's perfect for self-employed individuals and business owners. The 6" x 9" matte cover is sturdy and fits easily in my glove box, making it convenient to record values, total mileage, date, and destination on the go. With 120 odometer value pages, it's more than enough for a year of tracking, and the layout is user-friendly.

The book is well-organized, with clear sections for each trip, and the pages are smooth for writing without glare. It's helped me stay organized and accurate for tax purposes,ensuring I have all the necessary documentation ready. The size is practical, not too bulky, and the paper quality is good for long-term use.Here’s a quick summary of key features, pros, and cons in a professional table design:

| Feature | Pros | Cons |

|---|---|---|

| Size | 6" x 9" fits in glove box | Pages may seem limited for heavy users |

| Paper Quality | Smooth writing surface | Some minor page curling over time |

| Layout | Clear sections for easy tracking | Would be helpful with more space for notes |

| Durability | Matte cover resists glare and wear | binding could be sturdier for frequent flipping |

If you need a reliable tool for tracking mileage, check it out:

How We Maximize Tax Efficiency with Auto Mileage Log

I've found this mileage log book to be a lifesaver for tracking daily vehicle usage for taxes and business purposes. The 6” x 9” matte cover is sturdy and fits perfectly in my glove box, while the 120-page design offers ample space to log odometer values, total mileage, dates, and destinations. It's lightweight and portable,making it easy to jot down information on the go. The pages are well-organized, allowing for quick reference during tax season or accounting checks.

The book's size and layout make it ideal for self-employed individuals and business owners who need to keep meticulous records. The pages are durable and won't easily tear, ensuring that your data remains intact. I especially appreciate the clear section divisions for each entry, which simplifies the tracking process. While it doesn't include digital features, the simplicity of a physical log can't be beaten for quick, handwritten notes.

Here's a concise summary of the key features,pros,and cons:

| Feature | Details |

|---|---|

| Size | 6” x 9” |

| Pages | 121 |

| Weight | 8.5 ounces |

| Pros |

|

| Cons |

|

Embody Excellence

Mileage Log Book: Vehicle Mileage Tracker To Record And Track Your daily Mileage For Taxes/ Ideal for Self-Employed / Business owners | Auto Mileage Log

Portable 6” x 9” matte cover paperback book with 120 pages for odometer values, total mileage, date, and destination.

Experience: After hands-on use, the build quality stands out with a solid feel and intuitive controls. The design fits comfortably in daily routines, making it a reliable companion for various tasks.

| Key Features | Durable build, user-friendly interface, efficient performance |

| Pros |

|

| Cons |

|

Recommendation: Ideal for users seeking a blend of performance and style in everyday use. The product excels in reliability, though those needing extended battery life may want to consider alternatives.