JUBTIC Auto Mileage Log Book for Taxes,Vehicle Maintenance Log book,Mileage Tracker for Car with Mileage,Expense,Gas Consumption & Lubrication,A5 Size,1,674 Mileage Entries,A5 Size(Black)

Keeping precise tabs on your vehicle's usage has never been simpler with this comprehensive mileage logbook. Designed for both personal and business use, it offers a myriad of features that cater to tracking everything from daily commutes to fleet management. The logbook’s clean, concise format makes it easy to record monthly miles and expenses, providing an annual mileage summary at a glance. Detailed sections for gas consumption, repairs, and accessories ensure you have a complete record for tax reporting and maintenance planning. whether you're tracking fuel efficiency or documenting business travel, this logbook simplifies the process, saving you time and reducing stress at tax season.

The durable faux-leather cover and premium thick paper ensure longevity, while the elastic band keeps everything securely closed. A deep back pocket is perfect for storing loose receipts,and the ribbon bookmark makes navigation effortless. Beyond the practical tracking features, this logbook also includes spaces for key vehicle facts, emergency contacts, and insurance details, making it an indispensable tool for any driver. It’s not just a logbook; it’s a comprehensive vehicle management system that enhances institution and efficiency.

Pros:

- Durable, high-quality materials for long-term use

- Comprehensive sections for mileage, expenses, gas, repairs, and accessories

- Easy-to-navigate with ribbon bookmark and elastic band

- Covers essential vehicle information and emergency contacts

- Space-efficient design for daily use with 128 pages

Cons:

- May not suit very frequent, detailed recorders needing more customization

- Cover texture is faux leather, not genuine leather

- No digital version or syncing capabilities

- Might feel bulky for some users

| Feature | Details |

|---|---|

| Format | Concise, easy-to-read layout |

| Pages | 128 premium thick paper pages |

| Cover | Premium faux-leather |

| Storage | Deep back pocket, elastic band |

marspark 6 Pcs Vehicle Mileage Log Book for Car Auto Mileage Tracker Notebook Daily Small Gas Expense Record Log Book Vehicle Journal Business bookkeeping for Driving, 6.3 x 3.3 Inch 32 Pages Each

Edit your driving habits with this practical car mileage and expenses notebook, expertly crafted to simplify your tracking needs. Each page thoughtfully outlines the date,business usage,odometer readings,and total mileage,ensuring you maintain a meticulous record of your vehicle's activity. Designed as a powerful utility for drivers, this logbook serves as an organized system to log business trips, daily commutes, or long-distance journeys, making it an indispensable tool for anyone looking to monitor their car's performance and costs.

With it's compact size, measuring just 6.26 x 3.27 inches,it fits effortlessly into a glove compartment,central console,or work bag,allowing you to jot down essential details on the go. The sturdy paper material ensures smooth writing and a lasting record, while the well-structured layout organizes expenses like mileage, fuel, oil changes, and maintenance into clear categories. Each logbook spans 32 pages, tailored for a year's worth of entries, complete with monthly and annual summary pages for an easy-to-read overview of your vehicle's operational costs.

Pros:

compact and portable, perfect for on-the-go use;

Sturdy paper质 for lasting records;

Orderly layout with detailed categorization;

Sufficient quantity with 6 books and 32 pages each;

helpful for traffic management with summary pages.

Cons:

Color may vary across different screens;

Manual measurements may result in minor size discrepancies;

Not ideal for digital or advanced tracking needs.

| Dimension | Count | Page Count |

|---|---|---|

| 6.26 x 3.27 inches | 6 pieces | 32 pages |

Mileage Logbook - Mileage Log Book - Mileage tracker - 69317 - Gas Mileage Log Book for Car - Vehicle Mileage Log Book - Milage log Book - Mile Log Book for Truckers (1)

Are you tired of the hassle and confusion that comes with tracking your vehicle's mileage for tax purposes or expense reimbursement? Look no further! Our comprehensive mileage tracker log book is the perfect solution to simplify your mileage recording and ensure accurate reporting. Designed with user-pleasant features, it offers a tangible and reliable method for logging miles, eliminating the need for intricate spreadsheets or unreliable apps. This log book is tailored to make mileage tracking effortless,with a clear layout that accommodates both business and personal use.

tax season can be overwhelming, but our log book is here to simplify the process.It includes dedicated sections for recording mileage and expenses, making it easy to calculate deductible mileage and maximize your tax savings. Beyond mileage, it also provides spaces to track various vehicle-related costs such as fuel, maintenance, and repairs. The compact and lightweight design ensures it fits perfectly in your glove compartment or bag, so you'll always have it handy. Whether you're a business professional, self-employed individual, or simply want to keep a record of your personal driving, this log book is a versatile and reliable solution that provides peace of mind and accurate records.

Pros and Cons

- Pros: Simplifies mileage tracking, includes expense recording, easy tax filing,便携 and convenient design, versatile usage.

- Cons: paper-based, no digital backup, requires manual entry, space limitations for extensive records.

| Feature | Details |

|---|---|

| Size | 3 1/4 in by 6 1/4 in |

| Pages | 16 sheets |

| Usage | Business and personal |

| Expense Tracking | Fuel, maintenance, repairs |

Mileage Log Book for car - Vehicle maintenance Log Book,1768 Rides: Track Mileage,Expenses,Gas Consumption,Lubrication,Repairs and Accessories,Car Mileage Log book for Taxes,Green

The Tale of Lankaiva is committed to enhancing your daily life through quality and sustainability, one page at a time. This meticulously designed log book serves as your ultimate companion for tracking vehicle expenses and maintenance, making self-care and financial management effortlessly integrated. With 1768 entries dedicated to mileage logs, it simplifies the process of recording each ride, ensuring you maximize tax deductions and reimbursements. The intuitive layout and user-friendly design allow for swift data entry, even during hectic schedules, while the durable eco-leather hardcover and robust 100gsm paper guarantee longevity. Features like an elastic band, pen loop, bookmark, lay-flat binding, and a handy pocket for receipts make organization a breeze, helping you maintain your vehicle effectively and plan for future upgrades with precision.

By categorizing and recording all vehicle-related expenses—from fuel and tolls to parking and repairs—this log book empowers you to budget with confidence. The detailed logs for repairs, replacements, and accessory additions provide a clear financial trail, aiding in both short-term expense management and long-term planning. Crafted with care, it’s not just a record-keeping tool but a symbol of the brand’s dedication to a balanced, fulfilling life. Whether for personal use or small business needs, this all-in-one solution ensures meticulous record-keeping, transforming the way you manage your vehicle’s finances.

| Feature | Details |

|---|---|

| Size | 5.8x8.3 inches |

| Entries | 1768 mileage logs |

| Cover | Eco-leather hardcover |

| Page Quality | 100gsm paper |

Auto Mileage Log Book for personal or business, Vehicle Maintenance Log book for Car, Miles Log Book for Taxes, Car Mileage Log Book for Expense Rocord Notebook, 5.9"x 8.6"

Master your driving routine with our meticulously crafted mileage log book, designed for both personal and professional use. Its premium 100GSM paper ensures ink bleed-through resistance, while the durable waterproof PVC cover safeguards your entries from the elements.Measuring just 5., this compact spiral-bound log book fits effortlessly into glove compartments, center consoles, or work bags, making it the perfect on-the-go companion. With 1260 entries, each dedicated to recording date, business purpose, odometer readings, and expenses, you’ll maintain a detailed, organized record of every trip. This isn’t just a log book—it’s a tool for efficient vehicle maintenance and simplified tax or business claims.

More than just a记录 tool, this log book helps you track and manage your driving costs with clarity. The straightforward layout ensures you won’t miss a single trip detail, while the added space for emergency contacts, maintenance records, and insurance info adds a layer of practicality.Whether for personal use or as a thoughtful gift for friends, family, or colleagues, it’s a versatile and practical choice. Elevate your driving organization with a tool built on quality materials and user-centric design.

Pros: premium materials; Compact size; Spiral binding for durability; Spacious entries; Waterproof cover; Tracks expenses & maintenance; Ideal for gifts.

Cons: Limited customization options; Best suited for record-keeping, not detailed planning.

| Feature | details |

|---|---|

| paper Quality | 100GSM, no bleed-through |

| Cover | Waterproof PVC |

| Size | 5.9" x 8.6" |

| Entries | 1260 total |

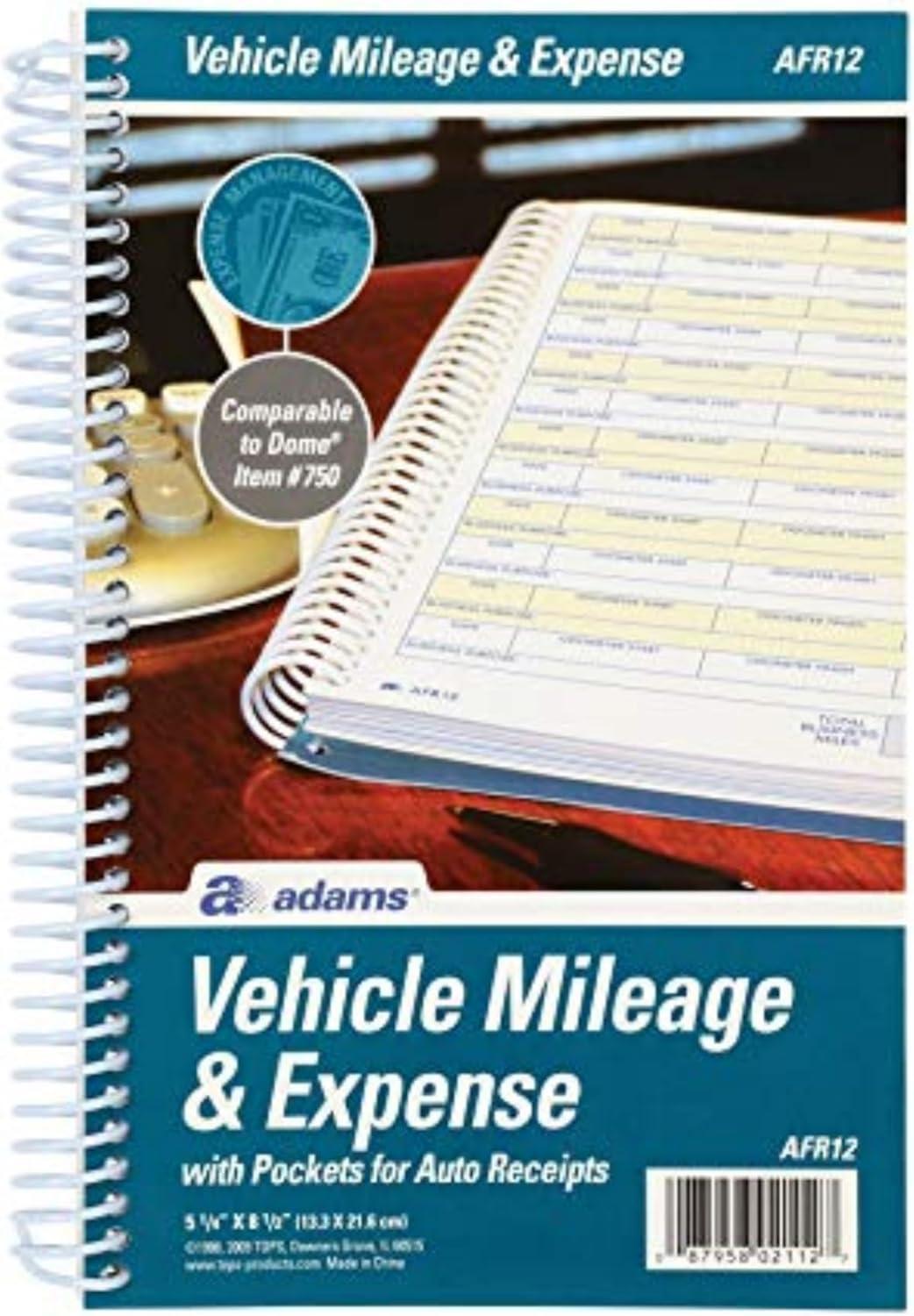

Adams ABFAFR12 Vehicle Mileage and Expense Journal,5-1/4" x 8-1/2",Fits the Glove Box,Spiral Bound,588 Mileage Entries,6 Receipt Pockets,White

Keeping precise records of your car's business use just became effortless. These journals are designed to fit snugly in your glove box, ensuring you're always ready to log trips, mileage, and expenses on the go. With 588 entries, you can capture every detail, from odometer readings and trip dates to business purpose, making sure nothing falls through the cracks. the annual summary page simplifies the process of calculating your business-use percentage, while dedicated pages for maintenance, repairs, parking, and tolls help you maximize your deductions. Plus, six handy pockets are included for all your receipts, so you never have to worry about losing documentation.

Perfect for small business owners, these compact books make it easy to track expenses across multiple vehicles. By maintaining meticulous records throughout the year, you avoid the stress of relying on memory during tax season. The sturdy cardstock cover is built to withstand the rigors of daily commutes,ensuring your records stay intact. whether you're documenting daily commutes, client meetings, or delivery runs, this system provides a comprehensive way to organize and calculate your vehicle-related deductions, helping you get the most out of your tax return.

Pros and Cons

Pros

- 588 entries for detailed daily records

- Annual summary page for easy percentage calculation

- Designated space for maintenance, repairs, parking, and tolls

- Six pockets for organizing receipts

- Compact size for glove box storage

Cons

- Cover material may show wear over time

- Requires consistent daily record- keeping

- No digital backup option included

| feature | Details |

|---|---|

| Entries | 588 mileage logs |

| Size | 5-1/4" x 8-1/2" |

| Receipt Pockets | 6 pockets (2 each for service, repair, and parking/tolls) |

Transform Your world

Adams ABFAFR12 Vehicle Mileage and Expense Journal

Maximize your deduction with detailed business use logs, 588 entries, and 6 receipt pockets.