Overview of Our Journey with the Vehicle Mileage Log Book

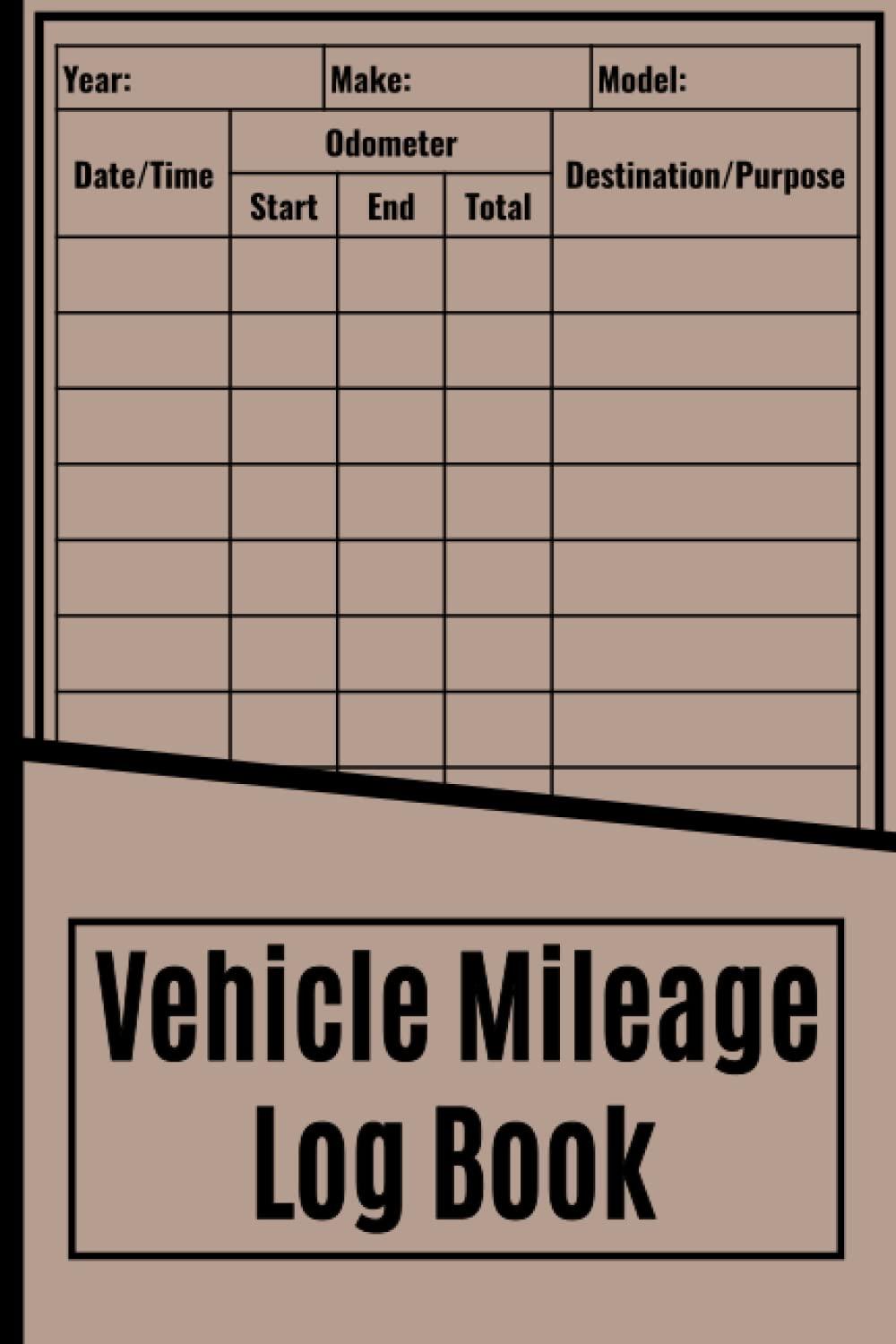

The Vehicle Mileage Log Book is a vital tool for staying organized and tracking vehicle expenses effortlessly. Whether for business or personal use, its 6" x 9" size makes it perfect for fitting in a glove box or bag, while the 110 pages provide ample space for detailed records. The simple, well-structured layout allows for quick entries of date, start/end mileage, purpose, destination, and total miles traveled, ensuring accurate tracking for tax deductions and business reimbursements. I found it particularly useful for IRS mileage tracking, as it keeps all necessary data in one place and helps maximize deductions.With a durable, professional design and a cover that stands up to daily use, this logbook has become an essential part of my routine. The inclusion of space for Year, Make, and Model of the car further enhances its versatility for both personal and business needs. The compact size doesn't compromise on functionality, offering clear record-keeping without the bulkiness of larger notebooks. It’s an ideal choice for small business owners, freelancers, and anyone requiring a simple, efficient mileage tracking solution.

Here’s a summary of its key features, pros, and cons in a professional, compact table design suitable for shopping sites:

| Key Features | Pros | cons |

|---|---|---|

| 6" x 9" size | Spacious enough for clear record-keeping | коммуникабельность Limited space for some users |

| 110 pages | Easy-to-use layout | онлайн No digital tracking options |

| Durable cover and pages | PORTABLE & convenient | 不如某些高级版本设计美观 |

Exploring the Core Features That Simplify car Taxes and Expenses

I've been using this mileage log book for my car taxes and business expenses, and it's incredibly helpful. The 6" x 9" size fits perfectly in my glove box,making it easy to log trips on the go. The layout is well-structured, with space for date, mileage, purpose, and destination. It's simple yet effective for tracking all my necessary info for tax deductions and business reimbursements. The durable cover and sturdy pages ensure long-term use, and it's great for both personal and business use.

The book has 110 pages, which is more than enough for a year's worth of entries. Recording data like year, make, model, odometer values, and total mileage is straightforward. It's particularly useful for IRS mileage tracking and maximizing tax deductions. While it's simple, it covers all the essentials without any unnecessary complicated features. The design is clean and professional, making it a great tool for anyone who needs to keep meticulous records.

Here's a summary of key features, pros, and cons:

| Feature | Details |

|---|---|

| Size | 6" x 9" |

| Pages | 110 |

| Format | Date, mileage, purpose, destination |

| Use | Tax reporting, business reimbursements, fleet management |

Pros:

- Compact and portable

- Easy-to-use layout

- Spacious enough for clear record-keeping

- Perfect for business and personal use

Cons:

- limited to manual entry

- No digital integration

- Basic design may not appeal to everyone

Deepening Our Understanding of Practical Usage and Organization

I've been using this mileage log book for tracking my vehicle expenses, and it's incredibly helpful for both personal and business use. The 6" x 9" size makes it portable enough to carry in my glove box, while the 110 pages provide ample space for detailed entries.I love how organized the layout is—logging date, mileage, purpose, and destination is quick and effortless. It's especially useful for IRS mileage tracking and maximizing tax deductions.

The durable cover and sturdy pages ensure long-term use, and the simple, clean design makes it easy to focus on recording important details. Whether I'm tracking for business reimbursements or personal tax deductions, this log book keeps everything in order. It's a must-have for anyone who needs to monitor vehicle mileage efficiently.

Here's a summary of key features, pros, and cons in a professional, compact table styled for shopping sites:

| Key Features | Pros | Cons |

|---|---|---|

| 110 pages | • Spacious enough for clear record-keeping | • Covers may get worn over time |

| 6" x 9" size | • Fits in glove box or bag | • Limited space for each entry |

| Durable cover | • Long-term use | • No digital backup option |

| Simple design | • Quick and easy entries | • Pages can be crowded |

Insights and Tips for Maximizing the Log Book's Potential

This Vehicle mileage Log Book is a fantastic tool for keeping my car taxes and expenses organized. the 6" x 9" size makes it compact enough to carry in my glove box, but it still offers ample space for detailed tracking. Each page includes fields for the date, start and end odometer readings, destination, purpose, and total miles traveled, making it easy to log every trip efficiently. Whether I'm tracking mileage for personal tax deductions or business expenses, this logbook has everything I need.Using it has been a game-changer for my record-keeping. The well-structured layout ensures quick entries without any hassle, and the durable cover and sturdy pages mean it can withstand daily use.It's perfect for small business owners, freelancers, or anyone who needs to monitor vehicle mileage for deductions or reimbursements. The simplicity of the design complements its functionality, making it a must-have for anyone who relies on their vehicle for work or personal use.

### Key Features, Pros, and Cons

| Features | Pros | Cons |

|---|---|---|

| 110 Pages | Spacious enough for clear record-keeping | Limited to one vehicle's tracking |

| 6" x 9" Size | Portable and fits in most glove boxes | Minimal cover space for additional notes |

| Durable & Professional Design | Sturdy pages for long-term use | basic cover style lacks customization |

| Easy-to-Use Layout | Quick and hassle-free entries | No digital tracking or reminders |

Making the Most of Each Page in Our Daily Grind

I've been using this 6" x 9" mileage log book for tracking my vehicle expenses and it's been incredibly helpful. The layout is simple yet effective, with dedicated spaces for date, start/end mileage, purpose, destination, and total miles. It's perfect for both personal tax deductions and business use, whether I'm a freelancer or just need to keep records for my own car. The cover is durable,and the 110 pages provide ample space without feeling cluttered.Best of all, it's small enough to fit in my glove box for easy access on the go.

The ease of use is a standout feature. I can quickly jot down entries after each trip without any hassle. It's especially useful for IRS mileage tracking and maximizing tax deductions.The design is clean and professional, making it suitable for both personal and business settings. While it's a straightforward notebook, it doesn't lack in functionality, offering everything I need to stay organized without unnecessary bells and whistles.

Here's a quick summary of the key features, pros, and cons:

| Feature | Details |

|---|---|

| Size | 6" x 9" |

| Pages | 110 |

| Use Case | IRS tracking, tax deductions, business expenses |

| Layout | Date, mileage, purpose, destination |

Pros:

- Well-structured format for quick entries

- Compact size for easy portability

- Durable and professional design

- Perfect for both personal and business use

Cons:

- limited customization options

- No digital tracking features

- Page layout is straightforward, no additional charts

Seize the Chance

Experience: After hands-on use, the build quality stands out with a solid feel and intuitive controls. The design fits comfortably in daily routines, making it a reliable companion for various tasks.

| Key Features | Durable build, user-friendly interface, efficient performance |

| Pros |

|

| Cons |

|

Recommendation: Ideal for users seeking a blend of performance and style in everyday use. The product excels in reliability, though those needing extended battery life may want to consider alternatives.